one. No normal cash flow Home finance loan corporations really need to confirm which you could repay a house loan. Commonly, Which means looking at every month income according to W2 tax sorts. But most seniors received’t have an everyday monthly funds movement to show lenders.

Financial information and facts. Contain all sources of earnings and supply proof of these. You’ll also need to provide the details within your debts and liabilities.

Near We update our details regularly, but information and facts can alter in between updates. Validate specifics With all the company you are considering before making a choice.

However, payday loans often feature exorbitantly superior fascination prices and costs, which often can lead borrowers into a cycle of financial debt. Seniors need to solution these loans with caution, comprehension the possible penalties and Discovering other options right before considering payday loans as A final vacation resort.

Lenders glance past common documentation, for example W-2s or spend stubs, and as a substitute consider income movement from own And maybe small business financial institution accounts.

How to start a company Ways to select the correct business enterprise How to get a business Ways to open up a business checking account How to fund your small business Ways to get a company loan

Checking out alternate monetary solutions, such as focusing on strengthening credit rating scores or searching for guidance from reputable financial establishments, can help seniors regain Charge of their finances In the end.

When taking out a personal loan, it is important to borrow responsibly and only tackle 65 loan debt that can be easily repaid. Seniors should evaluate their ability to make well timed repayments and think about the influence on their General financial balance.

Mortgage loan escrow: Revenue collected as Element of a borrower’s every month payment to go over assets taxes, homeowner’s insurance policies and home loan insurance plan premiums to guarantee these are generally compensated punctually, reducing the risk of defaulting to the loan. The FHA necessitates mortgage loan escrow accounts for almost any loans the agency insures.

Premiums can vary based upon where you reside. Examine the latest premiums in your state with the inbound links below.

Vacation benefits credit rating cards0% APR credit cardsCash back credit history cardsBusiness credit history cardsAirline credit rating cardsHotel credit cardsStudent credit history cardsStore charge cards

He has become in the money media space for almost twenty years. He developed "The Clark Howard Show" for fourteen of those decades and has long been web hosting the "How you can Money" podcast for 6 yrs. He at this time hosts “The way to Cash”—that has covered debt, loan solutions and connected topics—3 times a week, and a personal finance radio present on KFI radio in La on Sunday afternoons. Essentially, he is been marinating in all points personalized finance for some time.

How can I reduce my FHA home loan payment? Growing your deposit can perhaps lessen your fascination amount, For that reason decreasing your monthly home loan payment. You might also be capable to reduce your every month payment by refinancing to a traditional property finance loan with A non-public lender In case your loan-to-price (LTV) ratio is seventy eight% or reduce.

The most effective strategies to score a very good level is for getting authorized with two or three various lenders and Evaluate the rates they supply you.

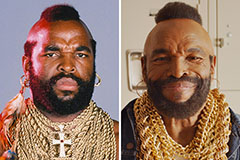

Mr. T Then & Now!

Mr. T Then & Now! Marla Sokoloff Then & Now!

Marla Sokoloff Then & Now! Melissa Joan Hart Then & Now!

Melissa Joan Hart Then & Now! David Faustino Then & Now!

David Faustino Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!